City board of education members discuss the district’s 2018 property tax rates

The Bardstown Board of Education prepares to open the public hearing regarding the 2018 tax rate Monday evening at the board’s meeting room in Central Office.

By JIM BROOKS

Nelson County Gazette / WBRT Radio

Monday, Aug. 20, 2018 — The Bardstown Board of Education’s public hearing Monday night to solicit input on its plans to set the 2018 tax rate did not end with the board finding much agreement.

TAX RATE CHOICES. According to Superintendent Ryan Clark, the board had a number of choices to consider when evaluating where to set the 2018 school tax rate.

TAX RATE CHOICES. According to Superintendent Ryan Clark, the board had a number of choices to consider when evaluating where to set the 2018 school tax rate.

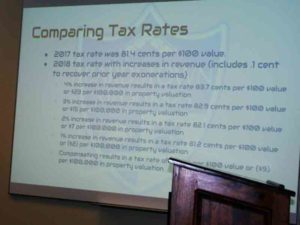

The 2017 tax rate is 81.4 cents per $100 of value. To create a 4 percent increase in tax revenue, the 2018 rate would need to be increased to 83.7 cents per $100 of value. Rates to create 3 percent and 2 percent tax revenue increase are 82.9 cents and 82.1 cents per $100 value respectively.

The compensating rate — the rate that would create about the same amount of tax revenue for 2018 as the district received in 2017 — 80.5 cents per $100 value would represent a tax rate decrease due to the increases in the assessed value of real estate within the city.

TAXING DEBATE. Only one person spoke to the board during the public comment period — Patricia Murray Boone, a retired teacher who still works as a substitute.

“Just because you are sitting in these positions and have the privilege of doing this — it does not make it fair,” Boone told the board of raising the school tax rates. “Show consideration for our hard-working families.”

Boone’s concerns did not fall on deaf ears.

Board member Andy Stone said he echoed Boone’s concerns, and he suggested the board set the tax rate for a 2 percent tax revenue increase rather than the full 4 percent maximum allowed that isn’t subject to a recall vote.

The 2 percent rate would generate additional revenue during a time when the local economy is going well, he said, adding that he would make a motion at Tuesday’s board meeting to seek the board support of the tax rate.

Board member Jim Roby said he was too understood Boone’s comments. “I’m on a fixed income and I see her points very clearly,” he said.

But Roby said he didn’t think he could support Stone’s suggested that the board set the tax rate for a 2 percent revenue increase. Roby said it was important to continue to adequately fund the district’s financial needs.

“We can’t sit on our laurels, we have to keep moving forward,” he said. Adding that he would prefer to see the rate set at a higher rate that would create at least a 3 percent tax revenue increase.

“We have to give our kids the chance to be successful in this world,” Roby said.

Board member Franklin Hibbs said he supported setting the tax rate to create the full 4 percent revenue increase, as did board member Kathy Reed.

“We don’t know what will go up in price next,” she said. “Set the rate that meets the need.”

In his presentation to the board, Clark explained that in the past 10 years, the amount of state financial support the district receives continues to decline. In 2008, state funding made up 56 percent of the district’s overall funding. In 2018, state funds now make up 48 percent of the district’s overall budget.

NEXT UP. The board will decide on its 2018 tax rate at its meeting Tuesday at noon in the board meeting room in the district’s Central Office on North Fifth Street.

-30-