City examines options for new tax rate; splits vote to OK compensation plan

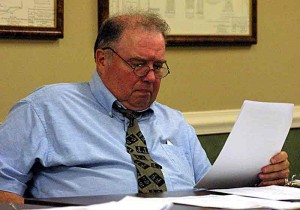

City Clerk Barbie Bryant and Councilman Fred Hagan examine documents prior to the beginning of Tuesday’s council meeting. Click to enlarge.

By JIM BROOKS

Nelson County Gazette

Aug. 29, 2012, 2 a.m. — The Bardstown City Council discussed its options for setting the new tax rate for the coming year at its Tuesday night council session. The council took no action, but planned to meet again.

Mike Abell, the city’s chief financial officer, presented the council with three options:

1. A compensating tax rate of 18.7 cents per $100 value, which will generate about the same revenue as last year’s rate;

2. The same tax rate from last year, 18.8 cents per $100, which produces about additional revenue; or,

3. A tax increase to 19.5 cents per $100, which produces the maximum 4 percent increase in revenue allowed by state law without a referendum.

The current year’s budget was calculated on the compensating rate, Abell said.

The city has the option of setting the rate anywhere in between the compensating rate and the 4 percent maximum, he explained. If the council decides to increase the rate, they are required to hold a public hearing prior to taking action.

The 19.5 cents per $100 tax rate will generate about $60,000 more in tax revenue over last year, Abell told the council.

LOOKING TO THE COUNTY TO AVOID TAX HIKE. Abell said the council might want to look at the funding it provides to help operate some joint city-county programs.

“Is the city council comfortable with the amount we’re paying for some of these shared programs?” Abell asked. “I think that’s an area you can look and maybe avoid a tax increase.”

For example, he cited the city’s contributions to the joint city-county recreation program, where the city provides about 75 percent of the funding while two-thirds of the participants are county residents.

Sheckles suggested the council have a finance committee meeting to discuss the funding issues.

Regarding setting the property tax rate, Sheckles called the higher tax rate to create a four percent revenue increase was “the least painful one” for most people.

“I’m just looking for more transparency, rather than leaps of faith that we’re expected to take in some of these things.”— Tommy Reed

|

CLASSIFICATION & COMPENSATION PLAN. After more a month of discussion regarding the ordinance that establishes the city’s pay ranges and job titles, the council voted in a 4-2 split to approve the measure’s first reading it spent time defending and criticizing the document.

After Councilman Fred Hagan read a summary of the oridnance, Mayor Bill Sheckles apparently believed the ordinance would pass without additional discussion.

Councilman Tommy Reed said he appreciated taking time to have the classification and compensation plan changes explained in detail. But he was critical of how during June’s budget discussions, the council was told there would be no merit pay raises but later learned there were.

City employees received a 3 percent across-the-board pay raise; the council approved the mayor’s request to give an additional 2 percent to some lower-paid employees in order to make their pay more competitive. Larry Green, the city’s assistant city administrator, told the council at its working session earlier this month those raises were in part merit raises.

Reed said he was also concerned that some city employees were being paid outside their job classification range.

“I’m just looking for more transparency, rather than leaps of faith that we’re expected to take in some of these things,” Reed said. “I really don’t disagree with some of the improvements we’ve made, but just how the council was left in the dark on some of these recent issues.”

Reed said the plan could use more input from the council and the finance committee. “I’m going to be voting in the negative,” he said.

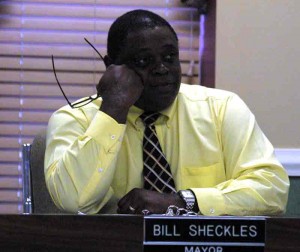

Mayor Bill Sheckles listens as the council discusses the merits of three property tax rate proposals.

When asked about his decision to vote against the plan, Reed told Sheckles he had questions about the addition of a part-time employee in the police department last year that was implemented without being part of the classification plan.

Councilman Fred Hagan supported a full-time stock clerk which was added to the classification plan. “You shouldn’t have a stock room without a stock clerk,” he said. “There’s just too much stuff out there and no one’s in charge of it.”

Councilman Bobby Simpson also questioned the need for a full-time clerk.

Sheckles said the whole issue came up because other employees were being pulled from their jobs to handle incoming deliveries at the city shop. “When they have to do that, I feel its a poor use of personnel to have my top-paid people trying to keep track of how many widgets we have,” he said.

Councilman Joe Buckman agreed with a need for a stock clerk, as did Francis Lydian and Roland Williams.

The vote to approve first reading of the classification and compensation plan was 4-2, with Reed and Simpson voting no.

-30-