Council discusses tax revenue options for the city’s $8.9 million general fund

By JIM BROOKS

Nelson County Gazette / WBRT Radio

Tuesday, Aug. 4, 2015, 11:55 p.m. — The Bardstown City Council discussed its options for raising sufficient revenue to avoid spending the city’s savings to pay general fund expenses during its working session Tuesday night.

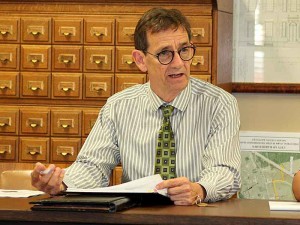

Larry Green, the city’s assistant administrator, discusses the council’s options for creating additional revenue to fund the full-time fire department. Click to enlarge.

Larry Green, the city’s assistant administrator, presented the council with a revised presentation that he gave the council’s finance committee Thursday, laying out options for raising additional revenue to help pay to add seven full-time firefighters in order to create the city’s first full-time fire department.

The fire department needs approximately $530,000 to fund the new firefighter positions. The recently approved 2015-16 budget pays those costs from the city’s general fund reserves — a practice it cannot continue, Green said.

The 2015-16 general fund budget is $8.7 million, Green explained, and the revenue to fund those expenses comes from several sources that include the occupational tax; property taxes; transfers of surplus utility revenue; state municipal aid; indirect cost allocations; and for this year, $740,000 from the city’s savings, known as unrestricted reserve funds.

For years, the city has relied on using surplus utility revenues to help fund the general fund, which pays for services that do not create their own revenue — fire and police protection, recreation and street repairs. But using utility profits to pay for these services is unsustainable in the long run, Green explained.

Councilman Fred Hagan told the council at its working session Tuesday he favored using a mix of all options the city has in order to create the revenue to fund the city’s $8.7 million general fund. Click to enlarge.

The council has a number of options to change the mix of revenues in order to fund that $8.7 million without using the city’s savings.

Green provided the council with several alternative scenarios that raise sufficient revenue by creating new taxes or changing existing tax rates.

To raise revenue and reduce the general fund’s reliance on surplus utility profits, the council’s options include:

— raise property taxes;

— increase the occupational tax;

— create an insurance premium tax, or;

— create a utility franchise tax.

INSURANCE PREMIUM TAX. This tax would be paid on insurance premiums paid within the city limits. The council could opt to exempt some insurance types, Green explained. Forty percent of the cities with an insurance tax exempt health insurance premiums. At a 7 percent tax rate, the city could collect an estimated $907,554.

UTILITY FRANCHISE TAX. This tax would be paid by individuals and businesses who use natural gas and electricity provided by LG&E/KU or Salt River Electric. A three percent utility franchise tax could generate $233,500.

OCCUPATIONAL TAX OPTIONS. The city’s occupational tax rate of .5 percent applies to all earned income up to $100,000, and it creates $1.9 million in revenue.

Green explained that 82 percent of the people who pay the occupational tax live outside the city limits.

Raising the tax rate to .75 percent and removing the $100,000 cap would raise an estimated $2.85 million; a 1 percent tax rate creates $3.8 million; raising the tax rate to 1.25 percent would raise $4.75 million.

The general fund pays for services that benefit those who live outside the city, Greene explained, citing these statistics:

- Fewer than half of the rescue runs by the Bardstown Fire Department in the last year were to rescue city residents.

- 67 percent of arrests and citations involve individuals who live outside the city limits.

- 61 percent of the city recreation department’s youth basketball participants, and

- 69 percent of the swim team, swim lessons and water aerobics participants were non-city residents.

Because non-city residents benefit from the city’s investment in infrastructure and services, Green said it stands to reason that those residents should pay for most of those services.

TAXING QUESTIONS. During the discussions, the consensus among the council favored raising the occupational tax to fund the fire department and prevent further use of the city’s savings; how much of an increase the council supports isn’t clear.

Councilwoman Kecia Copeland said she supported raising the occupational tax, but not creating an insurance premium tax or a utility franchise tax. She also suggested the council solicit the public’s input. Click to enlarge.

Councilman Fred Hagan told the council he supports not using utility profits to substantially fund the general fund. He presented the council with a funding scenario that raises the property tax rate to create a 4 percent revenue increase; creates a new 2 percent insurance premium tax; creates a new 3 percent utility franchise tax; and raises the occupational tax from .5 percent to .75 percent.

The result would provide a mix of funding sources and allow the city to greatly reduce its reliance on surplus utility profits, he explained.

The city’s property tax rate is the lowest its been since 2001, Hagan said. “I don’t think it would be inappropriate to take the 4 percent revenue increase.”

As part of his proposal, Hagan said the city’s finance committee should examine the city’s $18 million in its various reserve funds and ensure they are adequately funded. If those funds are adequate and the surplus revenues aren’t needed to fund utility projects, then it may be possible to eventually reduce customer’s utility costs, he said.

Councilman Roland Williams said he understood the need to increase revenue, but said he supported doing the minimum necessary to raise sufficient revenue.

Councilman Bill Buckman said he supported raising the occupational tax to 1.25 percent and removing the existing $100,000 cap. He also said he did not support creating additional taxes.

“If we’re going to do this, we want to do it once and do it once right,” he said. “I’m against raising any other taxes, and we should stay away from the insurance tax. I don’t think the people will tolerate another tax.”

Councilwoman Kecia Copeland said she wasn’t ready to support an insurance tax or utility franchise tax, but she believed raising the occupational tax to 1 percent was the best option.

“I’ve always felt we were behind and it should have been done during past administrations,” she said.

Copeland said she understands the funding is necessary, and advocated that the council get the public’s input as part of its decision-making process.

Mayor John Royalty said the general fund also needs to address other issues, which include sidewalk repairs. He told the council if they ever have questions about spending, he’ll be happy to discuss where money goes.

“Any money that’s spent in this administration, you will know where its going, and you’ll know where its spent.”

-30-