County school board splits on vote to approve 4 percent tax revenue hike

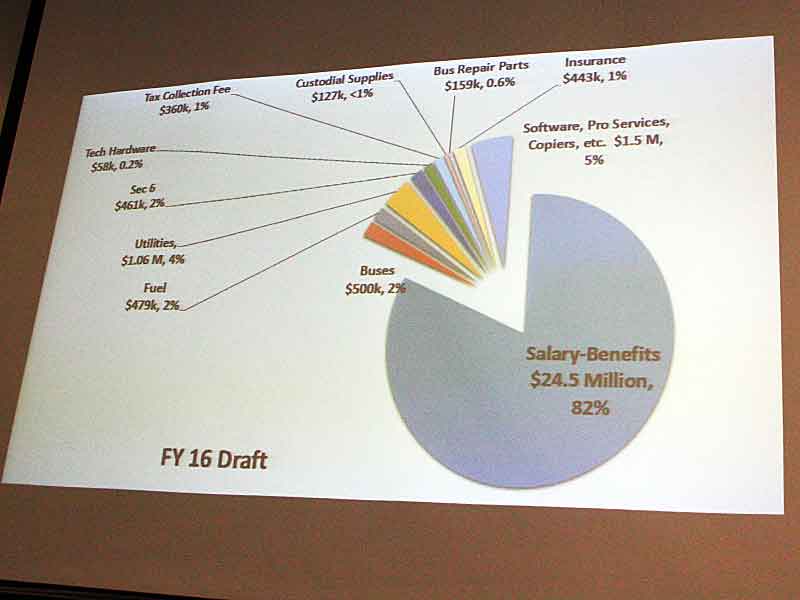

This slide shows the breakdown of the expenses in the 2015-16 school district budget. Salaries and benefits for the district’s employees account for 82 percent of its expenses.

By JIM BROOKS

Nelson County Gazette / WBRT Radio

Thursday, Sept. 3, 2015, 11 p.m. — In a split 3-2 vote, the Nelson County Board of Education approved raising the school property tax rate to generate a 4 percent increase in revenue.

The board’s action raises the property tax rate from 71.4 to 74 cents per $100 of assessed value. The tax rate change means a person who owns a home valued at $100,000 will pay an additional $26 in school tax over last year’s tax rate.

The new tax rate is expected to produce about $579,344 in additional revenue for the school district.

Superintendent Anthony Orr and Chief Operating Officer Tim Hockensmith told the board the additional revenue was necessary to help the district make up for cuts in state funding.

The district’s annual Support Education Excellence in Kentucky (SEEK) funding has dropped from $17.3 million in 2009 to a projected $15.2 million for the 2014-15 school year, Hockensmith told the board.

The district also is required to pay for teacher step increases and rank advancement annual, and those costs also must include increases in the number of teachers prompted by an influx of new students. “There’s a lot of costs to absorb,” he said.

Despite the arguments in support of the tax rate increase, two members of the board — Diane Berry and Diane Breeding — voted against taking the full 4 percent as allowed by law.

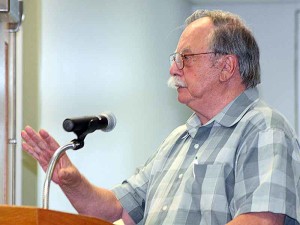

David Sallee said the board should consider how tax increases impact property owners, some of which are on fixed incomes.

PUBLIC OPPOSITION. At the public hearing held following the board’s work session, several members of the public voiced their strong opposition to the district’s plans to raise taxes and recommended it look instead at curbing spending.

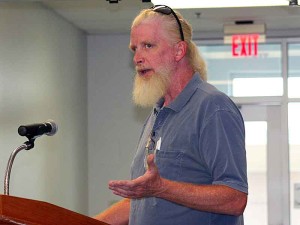

After hearing the justification for the tax increase, Earl Wilson walked to the podium and told the board “Figures can lie; liars can figure. This is all a bunch of crap.

“Four percent? Four percent over 10 years is 40 percent,” he said. “When is this going to stop? You need to stop some of your spending instead of coming back on us property owners and saying ‘we want more money.’ ”

Wilson cited the district’s decision last November to equip some of the district’s vehicles with GPS devices as an example of wasteful spending.

“That was a waste of six to eight thousand dollars. And why? Don’t you trust your maintenance people and you want to find out where they are? That’s garbage, pure garbage.”

Wilson closed his comments by telling the board that rising taxes left him with one main goal — “To sell every piece of property I have in Nelson County and get the hell out of here.”

Superintendent Anthony Orr discussed the reasons behind the recommendation that the board adopt a tax rate that will generate a 4 percent revenue increase.

Joseph Wayne Ritchie rising school taxes have a negative impact on those county residents who are retired, on fixed incomes or collecting Social Security.

“You take 4 percent here and 4 percent there, well, just think what that does,” he said. “We have to get a handle on spending.”

Marion County Schools have a lower tax rate, he said. “What are they doing right, or what are we doing wrong?”

David Davis reminded the board that it took a lesser increase a couple of years ago, and asked it to consider a lower rate or avoiding an increase altogether.

Charles Bobblett told the board that high taxes could impact economic development.

“People aren’t going to come to a county that’s going to charge them an exorbitant amount of taxes,” he said.

David Sallee told the board that he and other county residents have to live within their means, and so should the district.

“You have to consider us,” Sallee said. “You have to give the homeowners a break.”

He said the business and industry that locates here should pay more to support the schools, and he asked the board to hold the line on increasing taxes. He suggested the board consider select a compromise rate that would generate a 2-1/2 percent revenue increase.

“Just don’t forget, homeowners count too,” he said.

In other business, the board:

— received an update on the plans for the Early Learning Center expansion;

— received an update on the auditorium project planned as Phase III at Thomas Nelson High School;

— received an update on the district’s working budget that will be discussed at its regular monthly meeting on Sept. 15, 2015.

-30-