School board candidate protests tax hike while public hearing convenes

Board member Franklin Hibbs listens as Superintendent Brent Holsclaw discusses the proposed tax rate that was subject of Monday night’s public hearing.

By JIM BROOKS

Nelson County Gazette / WBRT Radio

Monday, Aug. 15, 2016, 8 p.m. — The Bardstown City Schools’ public hearing regarding a property tax rate proposal that will generate a 4 percent increase in tax revenue did not attract any comment — at least inside the school district’s central office.

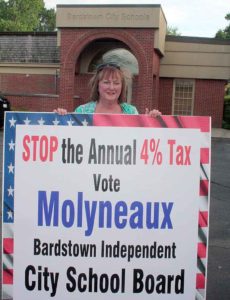

Board candidate Donna Molyneaux holds a campaign sign in protest of the city school board’s tax rate hearing that was conducted Monday evening at the board’s central office on North Fifth Street. Three candidates — Molyneaux and incumbents Andy Stone and Franklin Hibbs III — are vying for the two open seats on the city school board in the November general election.

Donna Molyneaux, a candidate for city school board, was outside the board meeting staging a protest of the proposed 4 percent tax revenue hike that was the subject of public hearing.

Most county school districts take the compensating tax rate, she said outside the meeting. The compensating rate is the tax rate that creates approximately the same revenue as the prior year’s tax rate

Molyneaux questioned the need for an independent school district, citing the duplication of the costs for administration and other services, and suggested a merger of the city and county school districts would save money.

“They have three schools and they need a school board and a whole separate administrative systems?”

Molyneaux said she is interested in only doing what’s in the best interest of doing what’s best for the district and taxpayers.

“I’m not running because I want to be on the school board for 25 years like some people,” she said. “I’m running because I want to have a fair property tax and do what’s best.”

Molyneaux had several campaign signs outside the board meeting, all of which protested the fact the school board has take the 4 percent tax revenue increase for the past 22 years. She said she did not actually attend the public hearing and speak against the tax increase “because it wouldn’t do any good.”

She called the hearing “a dog-and-pony show required by the state.”

“I think people feel like, “what good does it do?” They know this is just a formality that’s required. For the last 22 years people have come and complained and what good does it do?”

PUBLIC HEARING. Before the public hearing opened, Superintendent Brent Holsclaw told the board that state funding has dropped from an average of 61 percent in 2008 to 54 percent in 2014.

This has shifted a greater share of educational costs to local taxpayers, he said.

The decision to raise tax revenue was not one made lightly by he or the board, he said, but the board is in the position that requires it take action.

The proposed tax rate will raise an additional $383,821 over last year’s tax rate, Holsclaw told the board. The tax rate will mean an additional $17 tax on a property assessed at $100,000.

Overall, the 4 percent increase is expected to bring in revenues totalling $8,816,920.

The new rate for real estate and personal property is 80.4 cents per $100 in value. The motor vehicle tax remains the same at 53.1 cents per $100 value.

NEXT UP. The final approval of the new city schools tax rate will take place at the board’s regular meeting at noon Tuesday, Aug. 16, 2016.

-30-