Court leaves tax rate same; asks council to reconsider occupational tax hike

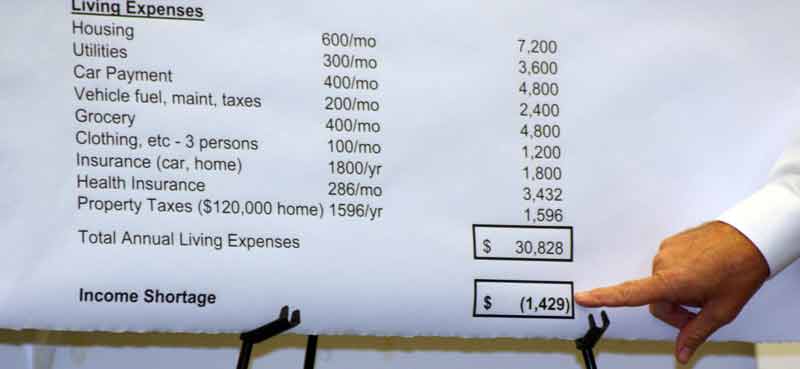

Judge Executive Dean Watts points to the possible budget shortfall that a single parent with two children could face if the Bardstown City Council approves a proposal to double its occupational tax. Click to enlarge.

By JIM BROOKS

Nelson County Gazette / WBRT Radio

Tuesday, Aug. 30, 2016, 4 p.m.– Nelson Fiscal Court approved first reading of its 2016 tax rate, which is the same rate as it has been for the last several years — 14.3 cents per $100 value for real estate and tangible property.

The court held a public hearing regarding the tax rate, which will bring in about $40,000 more this year despite the rate staying the same. The additional revenue is due to an increase in property assessments.

Judge Executive Dean Watts said the additional revenue will be used for maintenance and repair projects at the Civic Center and Old Courthouse.

The court will give final approval of the new tax rate at a special meeting on Tuesday, Sept. 13.

Watts explains how the proposed doubling of the city’s occupational tax will impact single parent families.

OCCUPATIONAL TAX. Watts also took time during the meeting to ask the Bardstown City Council to reconsider its proposal to double its occupational tax.

Noting that more than 54 percent of households in Nelson County are single parents raising children, Watts illustrated the impact of the city’s proposed occupational tax. He displayed a chart that showed how a single parent who earns $20 an hour with two children and average everyday expenses will likely find the additional tax more of a burden that the council might think.

“Those are the people who will suffer during this increase the city is proposing,” Watts said. “It doesn’t sound like much, but an additional $200 a year can be the difference between a family getting to go to a dentist or buying school supplies.

“It’s a shame that you have governmental entities that go out and create new departments without a funding mechanism in place,” he said. “It gives government a bad reputation.”

E-911 DISPATCH. Watts told the court that the E-911 Dispatch Board has written a letter to the City of Bardstown asking them to reach an agreement with the county to remain part of the joint dispatch center, or to let the dispatch center know where to forward the calls for city police and fire services.

The dispatch board and county government are moving ahead with or without the city’s participation, Watts said.

The Bardstown City Council has approved its own $24 911 fee on property tax bills in the city limits with the intent to claim the city’s portion of the county’s 911 fee. Watts has said previously that the county will not turn over the funds.

The Bardstown City Council is planning a special meeting Thursday to discuss a contract to have the Kentucky State Police Post 4 in Elizabethtown handle the city’s fire and police department dispatching.

In other business, the court:

— approved a request for an easement to allow placement of a handicap ramp at the Talbott Inn, the former Floyd building on Court Square.

— approved a tax moratorium request from the Domino Family Trust, for the former Blue Grass Entertainment & Expo Complex on Sutherland Road, in preparation for the new Whiskeycraft Distillery complex. According to the application, the company plans to spend up to $875,000 on the property, which will include the distillery, a visitor center/tasting room and an event venue. NFL football legend Lou Palatella and his wife Marci Palatella are behind the project.

NEXT UP. Nelson Fiscal Court’s next regular meeting is Tuesday, Sept. 6.

-30-