County school board OKs compromise tax rate for 3% revenue increase

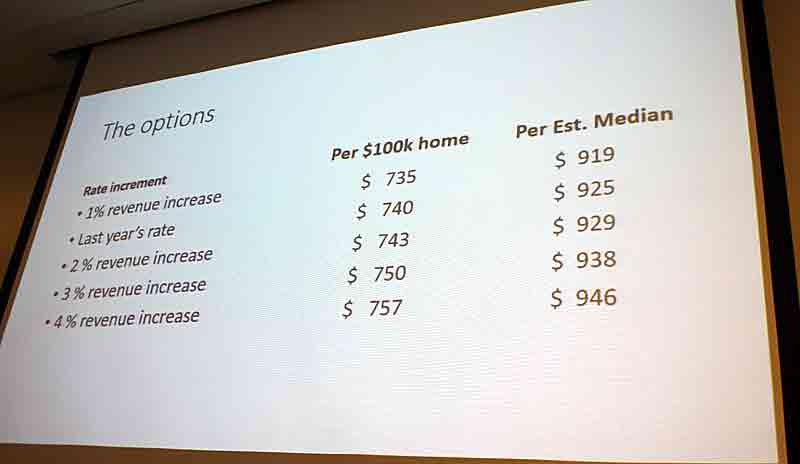

A Powerpoint slide illustrating the tax rate options the Nelson County Board of Education considered during its meeting Tuesday night. The median home value was estimated at $125,000. Click to enlarge.

By JIM BROOKS

Nelson County Gazette / WBRT Radio

Tuesday, Sept. 6, 2016, 10 p.m. — The Nelson County Schools Board of Education approved a compromise tax rate Tuesday night after a public hearing and the board’s debate regarding the tax revenue increase.

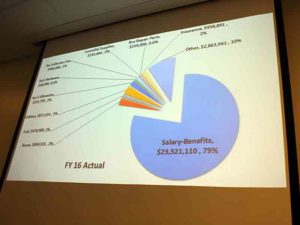

Superintendent Anthony Orr presents data supporting his recommendation for a tax rate to create a 3 percent increase in tax revenue.

In a 3-2 vote, the board approved a 2016 tax rate that will bring in an additional 3 percent revenue over last year’s tax rate — a tax revenue increase that is less than the 4 percent hike the board originally discussed.

The new rate — 75 cents per $100 value — is a 1 cent increase from last year’s rate and will produce an additional $462,607 in new revenue.

Due to an increase in the assessed values of property in the county, the district’s compensating rate option — the tax rate that would have produced about the same tax revenue as last year — would have required the board to lower the tax rate from 74.0 to 72.8 cents per $100 value.

In his presentation to the board, Superintendent Anthony Orr said he would like to see the board use the additional tax revenue to give an across-the-board 1.5 percent pay increase to district employees. The board took no action on the raises, but will likely address the issue at a future board meeting.

Board members Larry Pate and Diane Breeding voted against the new tax rate, which is 75.0 cents per $100 of value for both real estate and personal property.

Pate told the board he could not vote for another tax increase. He pointed to the fact that the board’s annual tax increases hurt seniors and those who have to live on fixed incomes — like himself — find themselves struggling with higher costs and rising taxes.

After giving the matter a lot of thought over the weekend, he told the board he could not support any tax increase this year.

“The more I thought about it, the more I think there has to be another way to raise funds other than the property tax,” Pate said.

“I agree that we need to help the schools and the kids, but you don’t want to cut your own throat in the process,” Pate said. “I won’t go that route, and I don’t think its right. I don’t think we should have a tax increase at all.”

If the district hadn’t raised taxes over the years, he said he could accept taking the 4 percent tax revenue increase.

Board chair Diane Berry defended the proposal to raise tax revenue 3 percent as a way to insure a quality education for future students.

“The way I look at it, we’re paying for the education of our children, our grandchildren and our great-grandchildren,” she said.

The only way to provide for that education is to provide sufficient funding, Berry said, pointing to a Powerpoint slide that highlighted how state funding to the district has dropped over the years.

“I know our choices aren’t easy, but sometimes you have to take the bad with the good,” she said. “I don’t like it because I’m paying those taxes too. But the only way we’re going to get our kids educated is to pay.”

A Powerpoint slide that illustrates how the school district’s FY 2016 budget is allocated. Click to enlarge.

CITIZEN INPUT. David Sallee was the only person who spoke at the public hearing regarding the tax rate.

“You have the opportunity to give the taxpayers a break,” Sallee told the board. The board has an obligation to provide for the educational needs of the county’s children, but it also has an obligation to the taxpayers, he said.

He acknowledged that state funding levels have dropped over the years, but even in the depths of the recession, the board took the 4 percent revenue increase. With a reported surplus in some district funds, he asked the board this year to avoid an increase and instead approve the compensating rate.

“If you can cut us some slack, please do,” he said. “That’s all I ask.”

ADEQUATE FUNDING, TEACHER PAY. Berry told the board the 3 percent revenue increase and proposed pay raise is important to helping keep the district’s salary schedule competitive.

The district loses good teachers to other school systems that pay better, she said. The district is 27th in teacher pay statewide, Orr said.

Board member Damon Jackey told the board that the decision on the tax rate is the most challenging decision he’s faces each year.

Orr told the board that the district’s good stewardship of public tax dollars was what allowed him to recommend a lower tax revenue increase.

In recommending the 1.5 percent across-the-board pay increase, Orr said he felt it was appropriate to reward district employees with a token of thanks for the great work they continue to perform inside and outside the classroom.

The new tax rate will mean a tax increase of $10 from last year’s tax rate on a home valued at $100,000, he said.

He called the 3 percent increase a win-win situation — a win for taxpayers because they won’t see the full 4 percent increase, and then a win for district employees, who could see an across-the-board raise that will be on top of mandated yearly step raises.

Salaries make up 79 percent of the board’s annual budget.

-30-