Salesmanship, not brute force, needed to explain proposed tax hike

By JIM BROOKS

Nelson County Gazette

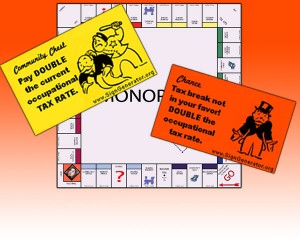

Monday, June 6, 2011, 11:23 a.m. — Bardstown Mayor Bill Sheckles says the city needs additional revenue to pay for the services its residents value and want to keep — and he has proposed changes to the city’s occupational tax to accomplish this goal.

For someone who has been a success as a sales executive, Sheckles is in for the sales job of his political career.

Sheckles was a recent guest on my radio show, “Brooks & Company” (11-noon Tuesdays on 1320 WBRT), and we discussed the need for revenue and proposals to raise the occupational tax.

In the interest of full disclosure, I remain unconvinced the tax hike is necessary; desirable, yes, but necessary? I’m not there yet.

I’m from the school of thought that you live within your means, however I know that those closer to the situation (including Sheckles, CFO Mike Abell and the council) probably have a much clearer picture of the city’s finances than I do. It’s not that I don’t think the city needs the money, I’m just not convinced a tax increase is necessary.

I know it has to be frustrating for the mayor and those who deal with the budget; trying to sell the public on a tax increase isn’t going to be easy. But the tone that I’m getting from the mayor is one that rubs this taxpayer a little bit the wrong way.

When the mayor says that he can’t see how anyone in their right mind could argue against the tax increase, or when he says that a tax increase looks like the common sense thing to do, it implies that myself and others who are skeptical must be lacking our right mind, common sense — or both. I’m not a sales professional, but I don’t believe making your customers (in this case, the voters and taxpayers) feel like they’re somehow clueless is going to build support for this tax increase.

The mayor is passionate about doing the right thing, and he’s explained that he’s not worrying about politics — he’s only out to do the what’s needed in the interest of the city. I respect him for that. But this always-skeptical conservative journalist remains skeptical about the absolute need for the proposed tax increase.

The city’s electric utility is its cash cow; more than $1 million is paid out of the combined utility fund to pay costs via indirect cost allocations (every city department is allocated its share of the city’s costs of doing business). On top of that, more than $500,000 comes out of the utility fund to help fund the general fund — which pays for services that don’t produce revenue, like fire and police protection, street repairs, etc. The mayor argues that these are services city residents want to have — services that need to be paid for.

One goal of the tax increase would be to eliminate the utility fund transfers to the general fund; during last Thursday’s tax hearing, it was determined that the tax hike might not eliminate the transfers, but would reduce the amount substantially. But transferring funds from the utility funds has been a long-standing practice; is there a reason why the fund transfers can’t continue?

One goal of the tax increase would be to eliminate the utility fund transfers to the general fund; during last Thursday’s tax hearing, it was determined that the tax hike might not eliminate the transfers, but would reduce the amount substantially. But transferring funds from the utility funds has been a long-standing practice; is there a reason why the fund transfers can’t continue?

The mayor said the cost of doing most anything has increased, and that’s true. But he’s also implied that the tax is needed to help pay for utility construction and maintenance projects. Again, I find myself questioning raising a tax if your justification includes one-time projects (construction) or even maintenance projects. Do the city utilities have funds reserved for these projects? Have the fund transfers over the years prevented the city from creating utility reserves?

During the public hearing the mayor stated off-the-cuff that the city’s population must have doubled in the past 10 years; not so, according to the official census. According to those figures, the city’s population growth from 2000 to 2010 was 1,326, a growth rate of just under 13 percent. And how many of those new residents were the result of the city’s annexations during Mayor Dixie Hibbs’ administration?

Download the Excel data showing Kentucky cities’ growth 2000-2010.

Robert Augustine’s Nelson County Gazette guest column suggests the proposed tax increase include a “sunset” provision, which would require the council to re-examine the tax hike after a couple of years and re-evaluate if the hike was still needed. It’s an idea with merit because it would force officials to defend the merit of keeping the tax, and allow adjustment of the rate if warranted.

One interesting statistic from last Thursday’s public hearing was the fact that of the 10,000-plus jobs in the city limits, nearly 80 percent of those employed in the city actually live outside the city limits. One of the mayor’s arguments for the tax is that the people who work in the city but live outside it deserve to pay for the benefits they receive by working in the city. The mayor said last week that these people are using the city’s services and using the roads without paying for them.

The mayor could make the same argument for taxing the unemployed, the retired and the disabled, who also use the same services and don’t pay for them (at least not through the occupational tax). The Kentucky Standard’s editorial board based its opposition to the proposed tax increase precisely on the fact that it wouldn’t apply to everyone. To the mayor’s credit, he’s proposed taxing only those who have jobs and can presumably afford to pay (at least) twice the amount of occupational tax on income over $15,000.

But before you ask the council to vote on raising the occupational tax, please Mr. Mayor, explain to the voters and taxpayers why the city needs to double the tax and remove the $75,000 cap. Don’t tell us simply “we need the money”; In my years covering local government, I have never known of a city or county government who complained of having too much money to spend. Tell us what exactly will need to be cut to balance the budget. Spell it out in detail. What hangs in the balance?

Even though 80 percent of those who will be affected by increasing the occupational tax live outside the city, your support — or opposition — to a tax increase will likely come up in the next election (this applies to the council, too). In today’s political climate, elected officials who earn a reputation as tax-and-spenders may face the consequences of their actions come Election Day.

-30-