Dave Says: Think long-term when considering investing in the stock market

Dear Dave,

I’m almost debt-free, and I’ll be finishing my master’s degree soon. I’m not from this country, so I’ll be returning home in the next three to five years. Considering my situation, would investing in the stock market be a good idea? I’ve been reading that the market is about to  crash, so I wanted to get your advice before doing anything.

crash, so I wanted to get your advice before doing anything.

Rahm

Dear Rahm,

If someone could accurately predict the stock market with certainty, that person would be a multi-bazillionaire. Right now, there are also articles out there that say the market is about to boom. There are always “glass half-full” and “glass half-empty” articles floating around. I wouldn’t avoid stock market investing based on one ridiculous article you read.

However, in your situation you may not want to invest in the stock market right now. History says you stand a fair chance of coming out with less than you put in if you don’t leave the money invested in the stock market alone for at least five years. The market cycles up, and the market cycles down. This really isn’t a big problem if you’re going to put your money in there, and leave it alone for 20 years or more. But three to five years? The historical data says you’ve got a reasonable chance of actually losing money.

So, I probably wouldn’t invest if you’re going to be gone in five years or less. Instead, when you’re settled and have a career in your home country, I’d advise looking into how you can invest there. You might even want to do some research, and find out if you can begin investing there now.

—Dave

Designate a percentage

Dear Dave,

I’m debt-free except for my home, and I have a small business with revenues of around $100,000 annually. About half of that is profit, and I typically pay myself 40 percent of the bi-weekly revenue. I’m in the media business, and I need to upgrade some equipment. At what point do I put back a little more money, or pay myself a little less, to make this happen?

Luke

Dear Luke,

I know what you mean, man. We’re in the media business, too, and around my office it seems like we buy more and newer technology every day. Really, it’s like a black hole. You could throw money into it the rest of your life, because practically the very moment you open the box it’s obsolete.

We finally decided to designate a percentage of our revenues to equipment replacement. Something is always being replaced, but this way we’ve got a limit and we’ve got something set aside to make our technology needs happen. It’s like the envelope system. If the envelope’s empty, we have to stop buying and put off whatever it is until the cash is available again.

I hope this helps!

—Dave

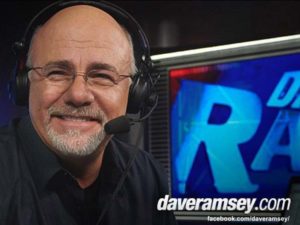

Dave Ramsey is CEO of Ramsey Solutions. He has authored seven best-selling books, including The Total Money Makeover. The Dave Ramsey Show is heard by more than 14 million listeners each week on 600 radio stations and multiple digital platforms. Follow Dave on the web at daveramsey.com and on Twitter at @DaveRamsey.

-30-