Nelson Fiscal Court discusses distilled spirits tax issue at special-called meeting

By JIM BROOKS

Nelson County Gazette / WBRT Radio

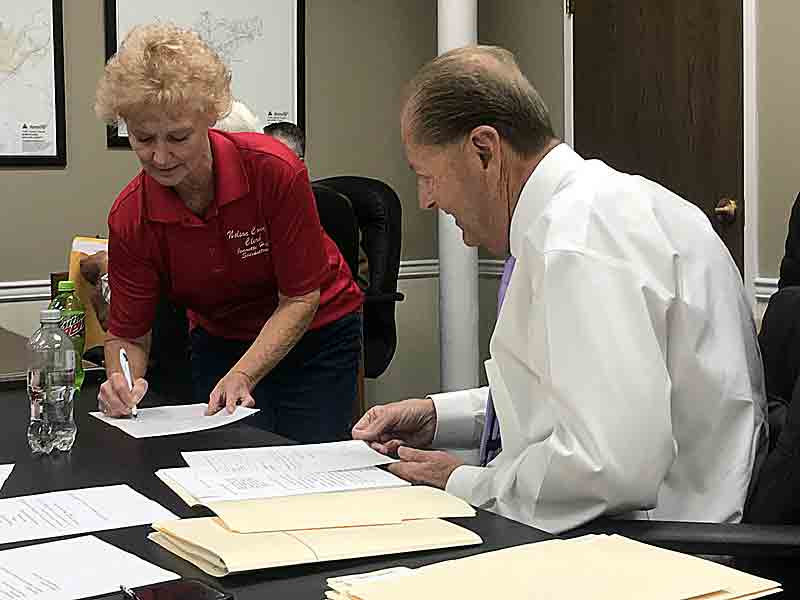

Tuesday, July 26, 2022 — Nelson Fiscal Court meet Tuesday morning for a special-called meeting in what Judge Executive Dean Watts said would definitely be his final meeting.

Most of the meeting focused on a discussion about the taxes placed on aging whiskey while it sits in a warehouse, and what the loss of that revenue would mean to those who receive that money, including fiscal court, local school districts, etc.

The Bourbon Barrel Taxation Task Force, a committee established by the Kentucky General Assembly, was recently presented with information by the Kentucky Distillers Association in defense of reducing or eliminating the tax.

At the committee’s recent meeting, Watts and others representing Nelson County were available to prorvide legislators with the impact that eliminating that tax revenue would have on Nelson County and other counties that house distilled spirits.

The total distilled spirits tax paid in Nelson County adds up to $8.7 million, which is mostly divided between the schools, fiscal court and other agencies. The cities also receive a share of the tax money.

In exchange for receiving the distilled spirits tax, the county forgives the property tax on all of the distiller’s property.

According to figures provided by Watts, this adds up to a total of $9.8 million in annual property tax that the distilleries don’t have to pay.

For the county school system, the loss of the distilled spirits tax would mean a loss of more than $2 million dollars from the county school budget.

The loss of the tax revenue would also negatively impact the Nelson County Sheriff’s Office in the loss of more than $200,000 in commissions. The real world impact of that loss would mean losing two fulltime deputies and a civilian office employee, the sheriff said.

With 11 active distilleries, Nelson County receives the most distilled spirits tax in the state.

Watts told the court that he will attend future meetings of the committee in Frankfort as a citizen because of the issue’s importance to the county.

COUNTY TAX RATE. The court approved a motion to advertise a public hearing to set the county tax rate at lower rate that will still generate 4 percent of new tax revenue. The proposal seeks to lower the county’s property tax rate from 13.9 cents per $100 value to 13.6 cents per $100 value.

An increase in property tax assessments countywide and new growth gave the county an increase in real estate values. Those higher values mean the county tax rate will drop, but the county tax revenue will still increase.

The 13.6 tax rate will generate a 4 percent revenue increase over last year’s 13.9 cents per $100 tax rate.

Because the new tax rate generates more revenue, the county must hold public hearings prior to approving the new rate. The hearings have been set for Tuesday, Aug. 16, 2022 and Tuesday, Sept. 6, 2022, and will be advertised as required by law.

In other business, the Nelso Fiscal Court:

— approved a resolution to accept state flex funds for repaving projects for parts of Mobley Mill Road and Yates Cooney Neck Road.

-30-